Want to navigate the stock market? Stock screeners are your superpower! In this list we have curated the best stock screeners for Indian markets. Discover stocks with above-average dividend yields and financial stability. Make informed decisions. Use these tools to stay ahead of the market. They have custom filters. They also have real time data analysis. These platforms have all you need for your stock research.

Get ready to level up your investing game. We have handpicked stock screeners for the Indian market. Scroll down to read our in-depth reviews and take your stock trading to new levels.

What are Stock Screeners?

Stock screeners are powerful tools. They help you filter stocks based on your needs. Here’s why they are useful:

- Stock screeners save time. They uncover potential investments, bypassing the need to sift through stocks.

- Customization: You can customize your search criteria. You can choose by price to earnings ratio, market cap, or dividend yield. Pick the ones that fit your investment strategy.

- Stock screeners let you compare multiple stocks side by side. You can see key metrics and make informed decisions.

- Risk Management helps you assess stock risk and volatility. They do this before investing.

A stock screener helps investors sort and identify stocks based on their investment strategy factors.

Stock screeners benefit both novice and experienced investors by giving them market insights. They provide a structured way to pick investments. The investments must match your financial goals and risk profile.

Definition and purpose of a stock screener

- A stock screener is a tool that helps investors and traders filter and narrow down a list of stocks based on specific criteria or parameters.

- It scans a database, filters and sorts the stocks in accordance with the user’s choices, and then displays the findings.

How Stock Screeners Work?

Stock screeners are powerful tools. They help you filter through thousands of stocks to find the ones that meet your criteria. Here’s what they can do:

- You can customize your search and screen stocks based on parameters like market cap, P/E ratio, and dividend yield.

- Real time Data: Stock screeners provide updates in real time. So, you have the latest information on stock prices and performance.

- Technical Analysis Tools: Many stock screeners have technical analysis tools. They include moving averages, MACD indicators, and RSI values. They help you make decisions.

- This app has a feature for comparing stocks side by side. It shows which stock matches your goals.

- Alerts and Notifications: Some stock screeners have alert features. They notify you when a stock meets your criteria.

Stock screeners help you find potential investments. You can also set stock screeners to specific parameters for your strategy. These tools save time by filtering through hundreds of stocks and giving you a list to research or act upon.

Criteria for screening stocks

- Market capitalization

- Index

- Sectors

- Company growth

- Financial ratios

- Shareholding patterns

- Dividend yield

- ROE

- ROCE

- Debt-to-Equity ratio

- Balance sheet

Types of stock screeners (e.g. intraday, fundamental, technical)

- Intraday screener for intraday trading and short-term swing trading

- Fundamental screener for analyzing a company’s financial statements and performance

- Technical screener for analyzing charts and patterns to predict future price movements

Key Features to Look for in a Stock Screener

Customizable screens and filters

- Allows users to create their own screens based on specific criteria

- Enables users to filter stocks based on their investment goals and risk tolerance

Real-time data and updates

- Provides users with up-to-date information on stock prices and market performance

- Helps users make timely investment decisions

User-friendly interface and navigation

- Easy to use and navigate, even for beginners

- Offers a seamless user experience

Benefits of Stock Screening

Stock screening has many benefits for investors and traders who want to make informed decisions:

- Efficiency is the ability to filter through hundreds of stocks. This is based on your criteria. It saves time and effort.

- Customization: Customize your search using price, market cap, and dividend yield. Use the criteria that fit your strategy.

Stock screeners give you insights into various stocks:

- Risk Management: Find risky investments by screening for volatility or debt.

- Diversification: Build a diversified portfolio by selecting stocks from different sectors or industries.

Also stock screening helps in decision making:

- Performance Analysis: Look at historical performance metrics. Examples are return on equity (ROE) and earnings per share (EPS).

- Trend Identification: Spot trends in the market by looking at patterns and indicators in the screened results.

Use stock screening tools and you will get better results:

- More Confidence: Data driven decisions.

- Higher Returns: Picking strong stocks can give better long-term returns. They are better investments.

Effective Stock Screener Strategies

Setting clear investment goals and objectives

- Define your investment goals and risk tolerance

- Identify the type of stocks that align with your goals

Identifying relevant screening criteria

- Determine the criteria that are most important for your investment goals, such as dividend yield, earnings growth, and positive cash flow.

- Use a combination of criteria to filter stocks

Interpreting and analyzing screener results

- Analyze the results of your screen to identify potential investment opportunities

- Use other forms of analysis and research to validate your findings

Free Stock Screeners in India

Stock screeners are a must have tool for investors to filter and select stocks based on their criteria and interest. In India there are many free stock screeners available online which offer:

- Customization: You can set parameters like market cap, P/E ratio, dividend yield and more.

- Real time Data: Latest information on stock prices and performance metrics.

- User Friendly Interface: Easy to use for beginners.

Try smart trading with IFMC Institute’s UDTS© Screener. It’s a free stock screener. It gives you in-depth analysis of stock price movement. It can track trade prices of over 100+ stocks in real time. For more details, the UDTS© intraday learning screener also shows the daily, weekly, and monthly credit rating trends. They let you assess companies’ financial health. It is a practical tool. It helps you make informed trades and plan stock strategies.

Remember UDTS© Screener doesn’t give you buy or sell recommendations – it gives you the tools to make smart decisions. Try it now!

One of the popular free stock screener in India is MoneyControl’s Markets on Mobile app. It has all the data analysis capabilities without any cost.

Another is Screener.in which is simple and efficient in screening Indian stocks based quarterly results on various financial ratios.

Investors analyze data with these free tools before making informed decisions about stock exchanges. By using the features of these platforms you can improve your stock selection and overall returns.

Finding Penny Stocks with a Stock Screener

Criteria for identifying penny stocks

- Market capitalization (less than ₹500 crores)

- Low stock price (less than ₹10)

- High growth potential

Strategies for finding undervalued penny stocks

- Look for stocks with low P/E ratios

- Identify stocks with high dividend yields

- Analyze the company’s financial statements and performance

Advanced Stock Screener Applications

Using multiple screens and filters

- Create multiple screens to filter stocks based on different criteria

- Use filters to narrow down the results of your screen

Combining fundamental and technical analysis

- Use fundamental analysis to analyze a company’s financial statements and performance

- Use technical analysis to analyze charts and patterns to predict future price movements

Common Mistakes to Avoid

Relying solely on a stock screener for investment decisions

- Use a stock screener as a tool, but not the only factor in your investment decisions

- Consider other forms of analysis and research

Failing to update and refine screening criteria

- Regularly update and refine your screening criteria to ensure they remain relevant

- Adapt to changes in the market and economy

Ignoring other forms of analysis and research

- Use a stock screener in conjunction with other forms of analysis and research

- Consider multiple perspectives and opinions before making an investment decision

Using Stock Screeners in India

Stock screeners are powerful tools. They help investors filter and select stocks based on their preferred criteria. They filter and sort stocks listed on specific stock exchanges such as the NSE and BSE. In India using stock screeners can give you:

- Faster Research: Stock screeners help you find investment opportunities fast. They filter through thousands of stocks based on things like price, market cap, and P/E ratio. To manage risk, use stock screeners to analyze past data and performance. This lets you make better decisions and lower the risks of stock market investing.

- Diversification: You can customize stock screeners. This lets you spread your portfolio across sectors and industries in India. Many stock screeners give real time updates. They let you stay updated with the market trends. So, you can make timely investment decisions.

- Better Decision Making: Stock screeners show you details about individual stocks or sectors. They let you to make strategic decisions for better returns.

Top Stock Screeners in India

Overview of popular stock screeners in India

- Finology Screener

- 5paisa Stock Screener

- Trade Brains Portal

- Intraday Screener

Top 10 Stock Screeners in India for Smart Investors

Stock screeners are vital tools. Investors use them to make informed decisions. In India, many stock screeners cater to smart investors. They have many features and benefits.

- You can set your own criteria with stock screeners. These criteria include market cap, P/E ratio, and dividend yield.

- Real Time Data: Many stock screeners give real time data updates so you can stay updated with the market.

- Technical Analysis Tools: Some platforms have advanced tools. They include moving averages and RSI indicators.

- User Friendly Interface: A user friendly interface is essential for easy navigation and fast screening.

- Historical Data: Historical data helps you to track past performance and take better decisions.

Before choosing a stock screener consider factors like ease of use consistent performance, filters, pricing, customer support.

1. IFMC Institute’s Learning Screeners

IFMC Institute offers special tools called learning screeners to help traders make smart decisions. These screeners, UDTS©, UDTS©-VSM, and UDTS©-IS, give clear and easy-to-understand insights into market trends, helping traders pick the best stocks for short-term and long-term investments.

UDTS©-IS: The Intraday Learning Screener

UDTS©-IS is designed to help traders learn about short-term trading, also known as intraday trading. It helps identify stocks that might go up (bullish) or down (bearish) on the same day. This screener focuses on understanding market trends and timing, which are crucial for successful trading.

UDTS©-VSM: The Fundamental Learning Screener

UDTS©-VSM is perfect for those looking to invest for the long term. It helps in picking stocks based on how safe and valuable they are, along with some technical insights about their potential movement. This screener is a great guide for anyone wanting to learn about long-term investment strategies.

UDTS© Screener: The Intraday Trading Companion

The UDTS© screener is an important tool for short-term traders. It analyzes stock prices in real-time, helping traders find good opportunities quickly. It also includes features that show trends in credit ratings, which can help assess a company’s financial health.

These screeners from IFMC Institute are educational tools designed to teach traders how to make better decisions, rather than giving direct investment advice.

2. Moneycontrol Stock Screener

Moneycontrol Stock Screener is a powerful tool for investors. It provides deep analysis of many stocks using fundamental analysis. Here’s why it stands out:

- Comprehensive Screening Tools: The platform has many screening tools. You can use them to filter stocks based on your criteria. These include market cap, sector, and P/E ratio. You can access detailed financial data like balance sheets and income statements. This allows in-depth research prior to making investment decisions.

- User Friendly Interface: With its simple design Moneycontrol Stock Screener is easy to use for all levels of users. This makes data more accessible and easy to interpret.

3. Screener.in

Screener.in is a useful tool. It focuses on the basics of stocks. It gives you in-depth insights about company financials and performance metrics. You can filter your search by applying custom filters. They are based on your criteria. They let you screen stocks as per your investment strategy. This helps you to find stocks which match your investment goals and risk appetite.

The platform offers free access to basic screening features. It’s useful for both beginners and experienced investors. They want to do initial research or deep dive into stock picks. Screener.in has a user friendly interface and robust database. You can use it to narrow down your search by parameters like market cap, P/E ratio high dividends, and debt levels.

You can use Screener.in’s data. It will help you make informed decisions. Use it while selecting stocks for your portfolio. This tool uses fundamental analysis and custom filters. They help you research and do due diligence before making investment decisions.

4. Trendlyne

- Trendlyne is a stock screener in India. It focuses on technical analysis indicators. So, it’s perfect for traders who rely on technical analysis.

- Those interested in insider trading can use Trendlyne. It tracks and gives insights into these activities. So, you can make informed decisions.

- The platform has tools for tracking portfolios and comparing them. You can use the tools to track your investments. You can compare them with benchmarks or other portfolios.

5. Investing.com India Stock Screener

Real-time data updates keep you informed about the latest stock trends and movements. They help you make timely decisions on your investments. This is a big advantage in the fast paced world of stock trading. Investing.com screener helps investors quickly filter and find stocks based on criteria like market cap and industry.

Global stock coverage gives an investor in you access to a wide range of investment options. With this much coverage you can explore beyond domestic markets and diversify your portfolio.

Charting tools provide interactive research capabilities. These tools help you examine stock performance. They help you identify patterns and make informed predictions. This leads to better investment results.

6. Tickertape

Tickertape is great for new stock screeners. It makes the process simpler for beginners. It provides educational content on investing. It helps you make informed investment decisions.

In addition to screening stocks, Tickertape goes further. It gives portfolio tips based on your risk profile. Tickertape helps you build a portfolio that matches your goals. It does this by analyzing your risk tolerance and investment goals.

Tickertape is a great resource for beginners. It simplifies stock screening and provides education at every step. Do you want to know about specific stocks? Or, do you want to optimize your investment strategy based on your risk appetite? Tickertape gives you the tools and knowledge to make informed investment decisions.

Tickertape features an intuitive design that makes navigation easy. It focuses on education and practical portfolio management. It is a complete platform for both new and experienced investors.

7. Equitymaster Stock Screener

Equitymaster Stock Screener gives you research based stock recommendations and insights. If you are looking to make informed decisions, this is the tool for you. It’s focused on long term investment strategies. So, if you want stability and growth in your portfolio over time.

A premium subscription gets you advanced screening features. They can help you pick good stocks. These features let you filter stocks. You can filter based on market cap, industry, ratios, and metrics.

Equitymaster’s research-based approach and data-driven recommendations make it a trusted platform. It is for those who want to build a solid investment portfolio. The platform provides in-depth research, empowering you to make informed investment decisions.

If you want thorough insights and personal advice, then use Equitymaster Stock Screener. It is the tool for you. Use this tool to make informed decisions. It is for new or experienced investors. Make decisions based on your financial goals.

8. Edelweiss Stock Screener

Edelweiss Stock Screener caters to the Indian market. It’s a comprehensive platform for in-depth analysis. Users can use industry-specific screening options. They can filter stocks based on specific criteria.

This stock screener has a great feature. It integrates with research reports and real time market news. This integration provides valuable insights, enabling informed decision-making with updated information.

The Edelweiss Stock Screener has tools for screening specific sectors. Investors can use them to narrow their search. They can find companies in industries that match their investment goals or strategy. This focus helps with precise stock selection. It helps you focus on stocks that match your preferences.

9. MarketSmith India

MarketSmith India is a complete investor toolset for investors who want to get into the stock market.

- Advanced charting tools to do technical analysis efficiently.

- The metrics show company performance. They give insights into the financial health and stability of stocks.

- MarketSmith India screener is the only one that offers screening based on CAN SLIM methodology. You can use it to filter stocks that match this proven strategy.

You have all the tools. They rely on a proven methodology. They include advanced analytics and screening. They let you make informed decisions in the Indian stock market.

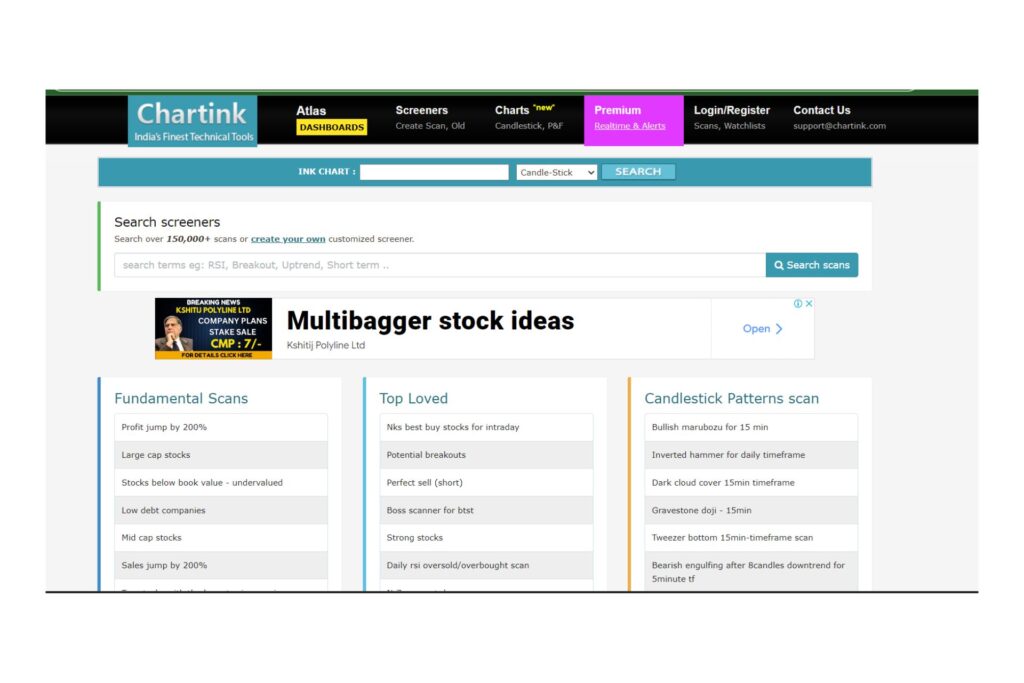

10. Chartink Stock Screener

Click to customize your scans with Chartink Stock Screener. Focus on patterns that match your trading strategy. This refines your search and yields targeted stock discoveries more filters.

Receive alerts for price and volume spikes to stay informed of real-time market moves. The alerts help you make quick decisions. Live data forms the basis for them. They help you make the most of market opportunities.

Use Chartink Stock Screener to screen across asset classes. You can use it to scan stocks, futures, options, and commodities. It is a one-stop platform for scans across all markets.

Use this stock screener’s flexibility to customize your search. Do it as you prefer and to meet your goals. Using it well simplifies your research. You can then focus on stocks that match your criteria.

Conclusion

Recap of the importance of using a top stock screener in India

A stock screener is a powerful tool for both companies and identifying potential investment opportunities. It helps investors make better and more informed investment decisions

Final tips for smart investment decisions using a stock screener

- Set clear investment goals and objectives

- Identify relevant screening criteria

- Use a combination of criteria to filter stocks

- Analyze the results of your screen and validate your findings with other forms of analysis and research.

FAQs

What is a stock screener?

A stock screener is a tool that helps you filter and find stocks based on specific parameters. These include market cap, price to earnings ratio, dividend yield, and so on. It makes finding investment opportunities easier.

How can I benefit from stock screeners in India?

Stock screeners in India let you narrow your choices. You can go from thousands of stocks to a few that match your goals and risk. This saves time and helps in taking informed decisions.

Are there free options to use stock screeners in India?

Yes, many free stock screening tools in India offer basic features. They can get you started with your research. These platforms give you valuable insights without asking for any money.

Why should serious investors use top stock screeners like Moneycontrol or Screener?

Top stock screeners, like Moneycontrol or Screener.in, offer advanced features. They also offer data analysis. These can give serious investors an edge. They give you in-depth market insights and help you find opportunities fast.

How to choose the best stock screener for me among the top 10 for Indian markets?

Pick the best stock screener from the top 10 for Indian markets. Base your choice on the user interface. Also, consider customization, real time data, and technical analysis tools. Also, consider customer reviews and ease of use, based on your investing style.